Last week, I told you it was coming. Today, I’m thrilled to say it’s here: Futurum Signal is live. And while “live” is one of the most overused words in tech, in this case it’s the real deal. Futurum Signal isn’t just another PDF report dressed up with a quadrant. It’s a continuously updated, AI-powered market intelligence platform designed to give DevOps and platform engineering leaders something we’ve all been chasing: clarity in the chaos.

Across the Techstrong network, the initial announcement lit up the communities. On DevOps.com, readers immediately connected the dots to the endless tooling debates—CI/CD, observability, security, platform engineering, you name it. Futurum Signal offers something different: a way to see, in real time, how the market is actually performing instead of how vendors want you to think it’s performing.

What’s Inside Futurum Signal

So how does Futurum Signal look at the market? Think of it as a living dashboard that goes far beyond the old static quadrant model.

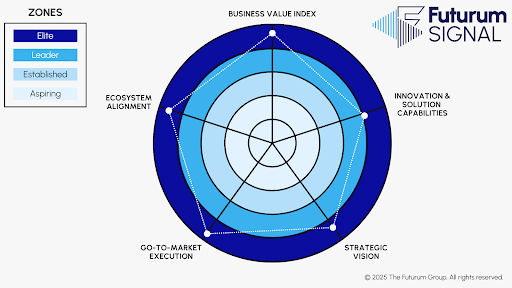

Take the Radar View. It maps vendors across five dimensions that really matter to practitioners and decision makers:

- Business Value Index – Are customers actually getting ROI?

- Innovation & Solution Capabilities – Are these tools evolving or standing still?

- Strategic Vision – Is there a real roadmap, or just slideware?

- Go-to-Market Execution – Can they deliver what they promise?

- Ecosystem Alignment – Do they play well with the other tools in your stack?

Instead of lumping everyone into one square, the radar places vendors into zones—Aspiring, Established, Leader, or Elite. That means you can instantly see the nuance: maybe a vendor has great innovation but lags in execution, or strong ecosystem alignment but a weaker vision. Futurum Signal surfaces that reality in a way a one-dimensional chart never could.

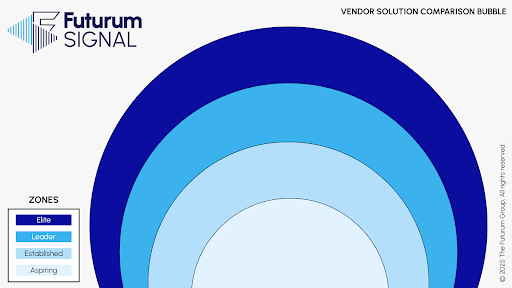

Then there’s the Vendor Comparison Zone. Picture concentric rings showing who’s breaking into the Elite zone, who’s holding steady as a Leader, and who’s still climbing from Established to Aspiring. For a DevOps leader sorting through dozens of vendor pitches, it’s a quick sanity check.

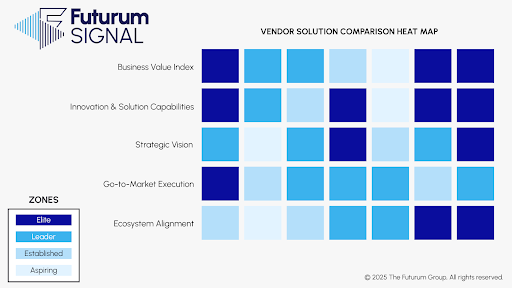

Finally, the Heat Map View provides a fingerprint for each vendor. Side-by-side boxes make it obvious who’s consistently strong across all five metrics and who is patchy—maybe great at innovation but weak on go-to-market, or strong in ecosystem but lagging in business value. For DevOps teams that have to place bets on vendors, this level of visibility is invaluable.

And that’s just what’s public-facing. The Futurum Signal platform also offers deep dives, drill-down dashboards, and customer sentiment overlays from millions of G2 reviews—giving practitioners the ability to see where the market is actually moving, not just where the marketing dollars are flowing.

Today’s Launch: Starting with Data Intelligence

With today’s launch, Futurum Signal’s first solution area—Data Intelligence Platforms—goes live. That’s not accidental. Data is the backbone of DevOps and platform engineering. It powers observability, AI, decision automation, and ultimately, velocity.

Over the coming weeks, Futurum Signal will expand into additional solution areas: Security Operations Platforms, Software Engineering Platforms, Agentic AI Platforms, AI Cloud Platforms, Sales/Service/Marketing Platforms, and Cloud Marketplace Platforms. Yes, the roadmap will evolve—but the direction is clear. Futurum Signal isn’t a one-off report; it’s a system that adapts as fast as the technology it tracks.

What I’m Hearing from the Market

Since announcing Futurum Signal last week, I’ve had conversations with vendors and practitioners alike. The feedback has been positive, but naturally, some common questions keep coming up.

Q1: How do you collect the data?

Futurum Signal stands on a three-legged stool. First, our exclusive partnership with G2, which brings unmatched scale—millions of real-world user reviews, not just a few hundred survey responses. Second, agentic AI, which continuously ingests and verifies public data sources. Third, Futurum’s own analyst team, layering on human expertise, validation, and context. Together, this creates a sturdier foundation than any single source could provide.

Q2: How do people access the data?

There are multiple entry points. Subscribers get continuous access to the solution areas they care about. Vendors will license Futurum Signal data for their own internal and external use. And for the broader market, Futurum will publish snapshots and executive summaries—not real-time, but enough to give you directional insights.

Q3: Can vendors influence the findings?

Here’s the bad news for some—you can’t. Futurum Signal isn’t your grandfather’s analyst report where a steak dinner and a sponsorship might magically improve your placement. The data is the data. You can brief the analysts, but you can’t game millions of G2 reviews or AI-verified public data. If you want to move up, you have to actually perform in the market.

Why Futurum Signal Matters to DevOps

For years, DevOps practitioners have complained about the “vendor noise” drowning out real-world performance. Too many tools, too many claims, too much marketing spin. Futurum Signal cuts through that by letting the data—and the practitioners who actually use these tools—speak for themselves.

Is Futurum Signal perfect? No, and it won’t be. It will evolve as AI evolves, as markets shift, and as new solution areas open up. But it’s a step toward something the DevOps community has desperately needed: a continuously refreshed, transparent, and data-driven view of the tooling landscape.

At some point, you have to stop tinkering and let your creation fly. For Futurum Signal, that moment is today. And for DevOps, it couldn’t come soon enough.