For the inaugural O’Reilly survey on serverless architecture adoption, we were pleasantly surprised at the high level of response: More than 1,500 respondents from a wide range of locations, companies and industries participated. The high response rate tells us that serverless is garnering significant mindshare in the community.

Below we examine three of the most notable findings from the survey.

Why Organizations Adopt Serverless

When we asked if respondents’ organizations had adopted serverless—defining “adopted” as entering into a contract with a vendor to provide serverless resources—we expected a low take rate for this relatively new and developing technology. Interestingly, a higher-than-expected 40% of respondents said they had adopted serverless (Figure 1). Of those respondents whose organizations have adopted serverless, more than 50% made the jump one to three years ago and 15% adopted serverless more than three years ago.

When asked about the benefits of adopting serverless (Figure 2), there were some stand-out issues. Reduction of operational costs was the number one reported benefit. Rather than buying racks and racks of servers that need to handle the maximum potential traffic and be idle most of the time, it seems that serverless’ method of paying by compute is proving to be beneficial to the bottom lines of organizations.

This likely goes hand-in-hand with the second most popular reason for adoption: scales with demand automatically. Instead of planning for average or maximum usage, you can deploy serverless and it will scale to current usage. You only pay for what is used. This scaling takes away the worry from random and unexpected traffic spikes or big seasonal traffic.

Serverless Concerns

Educating current staff was the number one serverless concern among respondents whose organizations have adopted serverless (Figure 3). That makes sense—with serverless being relatively young, formal training is difficult to find, specific documentation must be generated and case studies to learn from (while growing) are harder to come by. In addition, organizations sometimes discover that success requires custom features. These features evolve quickly as vendors vigorously compete to attract and retain customers—making up-to-date formal training difficult to maintain.

The second biggest challenge was vendor lock-in. Writing code for one vendor platform does not make it portable or simple to move elsewhere. Because serverless is a nascent space, it seems the market is waiting to see how the issue of portability among vendors plays out.

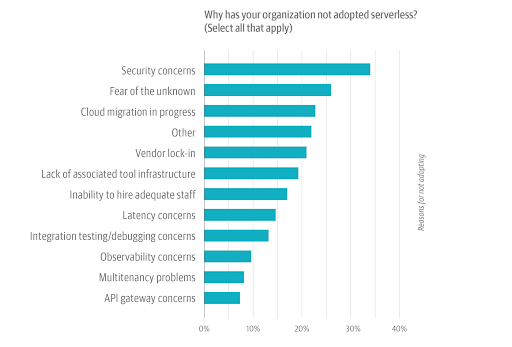

Turning to the 60% of respondents whose organizations have not adopted serverless (Figure 4), they cited security concerns as the chief reason they have avoided serverless. Because we’re in an environment where security is a paramount concern, the adoption of any new technology carries a lot of weight. Moreover, serverless introduces a different paradigm for data management where sensitive data is much more dynamic. With valuable business data not being managed or controlled by your company, there will always be concerns around who has access, how safe is it, whether or not the vendor looks at the data or metadata, and whether or not the software is patched or vulnerable to attacks.

Adjacent to security is also the challenge of meeting regulatory requirements such as GDPR. In the cloud on third-party servers, can you guarantee the same levels of security and quality as your own on your own infrastructure?

Serverless Vendors and Tools

The results in Figure 5 reflect what we know of the cloud market and mirror what we found in our cloud native survey in 2019. Amazon’s early-to-market serverless offering and dominant market position has given them a functional leg up on their primary rivals in the cloud market. However, both Microsoft and Google have ramped up their own serverless offerings and likely retain whatever market differentiation they’ve already developed in the wider cloud market—i.e., customers who already like and use Azure or Google Cloud Platform are likely to find the same advantages hold with Azure Functions and Google Cloud Functions.

Custom tooling ranked number one in serverless tools used by respondents’ organizations (Figure 6). This could mean there’s a market for standardizing or improving existing tools, getting companies to either migrate away from their in-house tools or to convince new customers to avoid spending the time to build something custom. It could also mean that current tools are not addressing everything needed to properly manage and deploy to serverless infrastructure.

Conclusion

Based on the survey, we expect the demand for serverless to grow in the near term as another worthwhile infrastructure option for many organizations. With no ties to specific technologies or programming languages, serverless can work with a wide range of tasks, and getting started has gotten easier over time.

You can see additional findings and analysis from the O’Reilly serverless survey here.

To learn more about containerized infrastructure and cloud native technologies, consider coming to KubeCon + CloudNativeCon EU, in Amsterdam. The CNCF has made the decision to postpone the event (originally set for March 30 to April 2, 2020) to instead be held in July or August 2020.

This article was co-authored by Chris Guzikowski. Chris is the senior content director at O’Reilly, where he manages the acquisition and development of content in software architecture and software development. He’s also the co-chair of the O’Reilly Software Architecture Conference. Chris has been working on technical content and technology marketing for more than 30 years.