The other day I was on the American Express website paying bills and browsing around the benefits and services afforded me when I ran across a “who we are” section. It read:

“We’re a global services company that provides customers with access to products, insights and experiences that enrich lives and build business success.”

Surprisingly, the term “financial” was missing from the description. This led me to wonder if other financial institutions are evolving how they think about themselves. Here are some other examples:

- Bank of America: “Here to help connect you to what matters most.”

- ING: “Empowering people to stay a step ahead in life and in business.”

- MasterCard: “As a technology company, we connect individuals, businesses and organizations around the world, creating greater opportunities for all.”

Financial Companies Love Their Customers

My unscientific assessment of various financial services companies suggests that they are centered on delighting their customers. They are transforming who they are by altering their customer engagement models and essentially becoming better software companies. MasterCard has even reclassified itself as a “technology” company. These companies are transcending the role of transaction engine to offer seamless, intuitive digital experiences for their customers.

And the proof is in the performance. According to Forrester’s Customer Experience (CX) Index, financial services firms, including retail banks, credit card companies, investment firms and auto and home insurers, are some of the top brands worldwide when it comes to CX.

You might think that large financial institutions would be digital laggards because of legacy infrastructure, regulatory compliance pressures and overall risk-avoidance. But you’d be wrong.

In another study, 81 percent of financial services firms said they are embracing digital to redefine their businesses, and 87 percent are on the DevOps bandwagon. Sixty-one percent even said they are disrupting their industry with advanced digital initiatives.

To stay competitive and improve their customer experience aptitude, financial services firms are undergoing significant digital transformation.

Getting the Pulse of Fintech Continuous Delivery Adoption

But how progressive are these firms in terms of their application delivery practices? Working with CA, Gatepoint Research recently surveyed more than 100 IT executives from financial services companies to take the pulse of where they are in continuous delivery adoption. Results can be found in this report and infographic.

First off, to see if these companies might be considered unicorns or stragglers, they were asked the total volume of monthly deployments in all environments. Forty percent fell at the low end with fewer than 50 deployments per month. Now, lower deployment numbers could mean that these are less agile organizations or that they have fewer applications in general. Somewhat correlative to lower deployment numbers, the survey found that 48 percent currently are not using an application release automation (ARA) solution. Without automation, it’s tough to scale release processes—particularly to keep up with agile development.

Moving up the spectrum, 41 percent are moderately prolific at 50-500 deployments per month, and then 15 percent are what I would consider rock stars with more than 500 (7 percent of those over 1,000). Those doing hundreds of deployments a month often have agile development teams and more modular applications. They likely have continuous delivery practices in place that push more frequent, iterative deployments left, helping higher-quality applications to move through the pipeline to production.

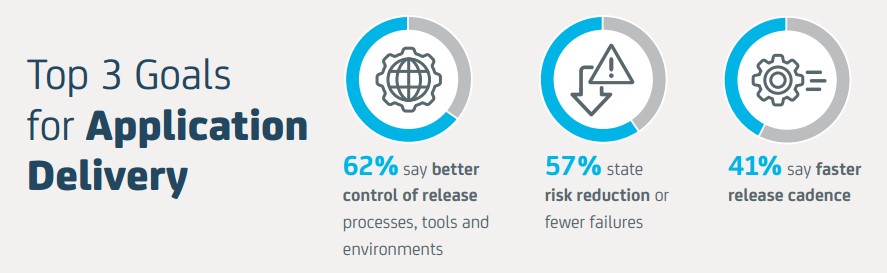

The primary application delivery goals for financial services firms for the next 12 months are to get better control of release processes, tools and environments; to reduce risk and failures; and to release applications more frequently. All of these needs typically stem from companies undergoing digital transformation—it feels more chaotic and disconnected, manual processes are breaking under the weight and there’s intense pressure to move faster.

Compliance was not a top goal, and the majority (83 percent) claim that their current release process is adequate to meet regulatory requirements. However, they did acknowledge that they could improve in terms of knowledge safekeeping and auditability of the release process.

The data certainly shows that financial services companies are adopting continuous delivery practices in some form and exploring solutions, including many open-source tools, to help them get the job done. They currently are focusing continuous delivery practices on tracking and reporting releases, planning and scheduling releases and automating test deployments. These practices ultimately help financial services companies to release high-quality applications anywhere at any time.

How Continuous Delivery Helps Fintech Win

Continuous delivery sits at the heart of many digital initiatives because of what it enables these companies to achieve for their customers:

- Delivering features and updates that customers need when they need them

- Delivering applications that meet performance and quality expectations of customers

- Delivering secure, compliant applications (for external and internal customers)

Continuous delivery enables continuous devotion to the customer experience.

Continuous Release: Fast Customer Response

With continuous delivery, you establish an application release workflow that automatically connects a developer’s update to parallel testing to staging and ultimately to production release. Because of the underlying end-to-end automation technology, these steps can happen quickly, seamlessly and with little to no manual intervention. Some might call it “push button release” or “zero-touch release.”

It’s a controlled, tracked, governed, collaborative process. Application stakeholders stay aligned as application changes traverse the pipeline. Your customers can have access to fixes, updates and new innovations in days instead of weeks or months.

Continuous Testing: Building in Quality

In contrast to the significant time penalties and shortfalls that can happen with manual testing, in the continuous delivery pipeline, testing is shifting left and happening in parallel. Hand-offs and feedback loops are automated and efficient.

Testing can happen earlier and without delay with the help of test environment simulation. Testing is on target through automatic test case creation, even from requirements. Testing is real-world with on-demand test data generation. And testing is rigorous with developers able to performance test apps at their end. The continuous testing that occurs as part of the process helps to build in quality and ensure top performance before reaching the customer.

Continuous Compliance: Audit-Ready Processes

Ensuring applications are compliant and secure is critical for your customers. It’s making sure customer information is safe and that application changes are tracked sufficiently for SOX or other reporting. It’s also about helping out those internal “customers” like auditors to prove compliancy and easily build reports.

An automated continuous delivery pipeline can track releases, apply role-based governance, orchestrate proper data masking, deploy security policy updates and provide an audit trail for application releases—who did what, when and why. All this data can be collected and reported easily, which saves time and effort for auditors. You essentially stay compliant and secure all the time.

Customer Satisfaction Through Automation

Financial services companies are laser focused on using technology to delight and retain customers. And continuous delivery is the application delivery practice that’s underpinning these efforts. The companies that are exceptional at this, with thousands of deployments per month, are using automation tools such as Application Release Automation (ARA). These tools are the backbone of continuous delivery, providing the automated orchestration, governance, tracking and reporting for your pipeline—development through production.

That’s why I’m not surprised that leading financial services companies make up a large portion of CA’s release automation customers, including Euroclear, GM Financial, ING, Jewelers Mutual and Western Union. Our customers put high value on delivering excellent customer experiences and are implementing modern software delivery methodologies, practices and associated tools to support their efforts. GM Financial recently said it is “the software company that does auto finance.”

If you are serious about customer satisfaction and staying ahead of nimble competitive threats in the market, you must get serious about end-to-end automation. It’s time to truly embrace the practice of continuous delivery to be able to consistently release applications that are progressive, always compliant and completely customer-satisfying.